Bitcoin: the tax change favorable to the poorest?

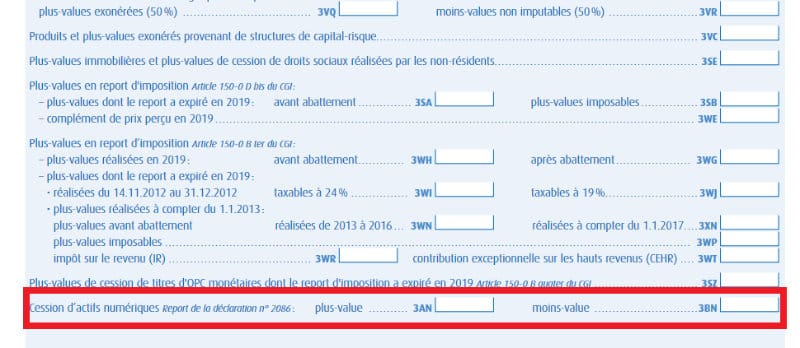

As Bitcoin is making a strong comeback and has just crossed the $ 60,000 mark for the first time in 6 months, the most modest French taxpayers may be able to choose another alternative to the 30% “flat tax” on capital gains related to digital assets. Because that’s how it works: at the end of each fiscal year, taxpayers who have made money with cryptocurrencies must declare it and a 30% tax is levied. The latter is made up of a flat-rate tax of 12.8% and social security contributions up to 17.2%. Except that if you have a tax rate lower than 12.8% (dirty poor!), It is disadvantageous. It would therefore be a question of removing this unfair “flat tax” and declaring the profits linked to cryptos with the rest of its income.

Please note, this amendment was adopted in committee, but the bill which covers all this must also be adopted in the Assembly …

With a stablecoin indexed to the Euro, avoid the tax declaration!

It must be said that the declaration, simple on paper, quickly becomes laborious. Because once you have calculated your profit (not easy with gains, losses, several cryptos, etc.), you end up declaring crumbs, which encourages Mr. Everybody simply not to declare its 100 or 300 € of capital gain. Because the rule is twisted and it applies even if the winnings are not in a bank account and as soon as they have been converted into FIAT (euros, dollars, etc.)

The solution ? Do not convert your earnings into currency, but into EUR-L! It is a stable cryptocurrency that has a value equal to the Euro. This “stablecoin” has another advantage: it is possible to switch your investments into EUR-L without paying capital gains tax on each movement. You can therefore sell Bitcoin, Ethereum (or others) upwards and buy back downwards while keeping your earnings in EUR-L. Then of course you will pay your taxes, but it will be easier to do it, without errors and in one go!

Coinhouse, the leading French player in cryptocurrencies

If you want to try this method know that you can acquire EUR-L at Coinhouse with a commission of just 1.49%. This French player recognized and registered with the AMF (Autorité des Marchés Financiers) allows you to buy, sell and monitor the markets from the same interface. You can choose from 35 cryptocurrencies from the most classic (Bitcoin, Ethereum, Cardano, Litecoin, Ripple, etc.) to the most recent and promising. Chez them out is very well explained, the interface is in French and registration is quick. It is even possible to obtain personalized advice for your investments.