This is the best app for all bank customers

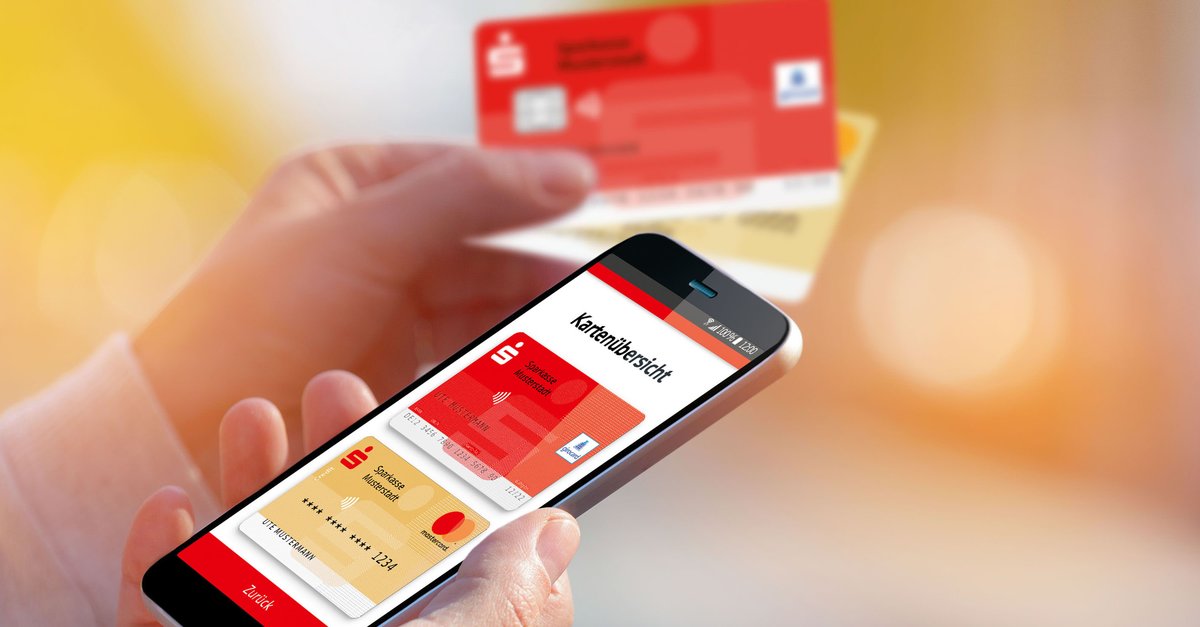

If you want to manage your finances on your smartphone, there is no better way than with the “Sparkasse Your Mobile Branch” app. This is the result of the Stiftung Warentest in its comparison of multibanking apps. Best of all, you don’t even have to be a Sparkasse customer.

In times of zero interest rates and fewer and fewer free accounts, quite a few consumers are switching banks. Then it means canceling old accounts, deleting old apps and setting everything up again from scratch – unless you’re using one Multibanking app. Accounts can be managed and transfers made there, largely independently of the respective bank.

Contents

Savings bank app wins at Stiftung Warentest: The best choice for customers regardless of which bank

Stiftung Warentest has now identified the best of these multibanking apps: The winner is the savings bank app “Sparkasse your mobile branch” with the overall rating “good” (2.1) – available for iOS as well as Android (source: Stiftung Warentest). The iOS version performs a little better because you can divide payments into self-named categories – a basic budget book is integrated right away.

Transfers can be made easily, for example with a photo of an invoice. In addition, push messages can be activated for incoming and outgoing payments, so users can Overview of their account movements via a central contact point.

As befits multibanking, not only accounts from a savings bank can be managed via the app. Also Accounts with cooperative banks, Deutsche Bank or Postbank can be added to the Sparkasse app. Even if you are not a Sparkasse customer at all, you can use it.

The savings bank app convinces in the test with its easy handling and a good range of functions. Also, unlike some standalone applications, it’s free. When it came to protecting personal data, the Savings Banks app was able to outperform all other candidates.

Data protection deficiencies and fewer functions: where other apps fail

In terms of the other criteria, it is largely on par with the “Finanzblick Online Banking” app. However, this is less convincing in one respect. The testers found Deficiencies in the data protection declaration: Mandatory contact details are actually missing here.

How TAN procedures protect you in online banking:

14 multibanking applications were tested. A small shortcoming of the Sparkasse app: It is not free of advertising. Like apps from other banks, however, only their own offer is usually advertised here. In the case of independent apps, there are sometimes free basic versions that only unlock all functions in the paid version.