Savings interest puts the competition in the shade

Klarna has long since deviated from the path of a pure payment service. The financial app is being further developed and is intended to increasingly become a banking alternative. A new offer is particularly interesting for savers.

Version:Web

Languages:German

Klarna wants to get away from the image of a pure payment service and is going its own way. For many German customers, this plan comes just in time: The Swedish financial app started a fixed deposit account. For the younger generation, who know little else than low or zero interest rates, this is almost a foreign word.

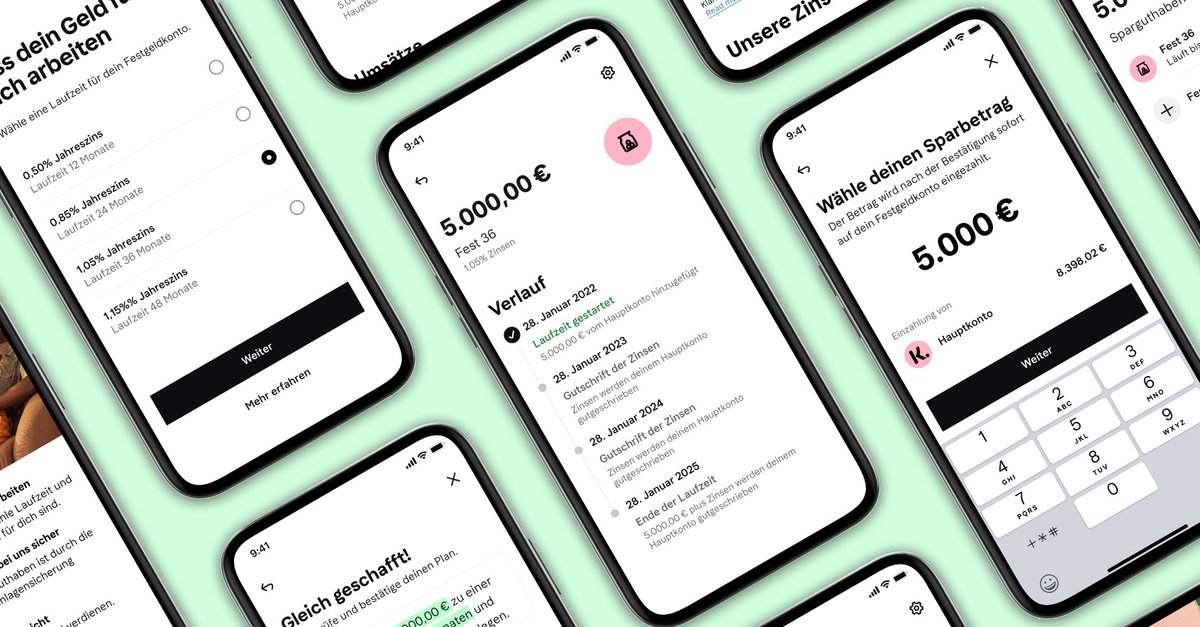

Fixed deposit+ from Klarna: up to 1.15 percent interest per app

Customers can choose between 12, 24, 36 and 48 months term. Klarna guarantees an effective annual interest rate of 0.5 percent, 0.85 percent, 1.05 percent or 1.05 percent for the various terms over four years even 1.15 percent. This sometimes clearly beats comparable offers for the respective investment period – and also Klarna Bank’s own desktop version.

With the investment account called “Fixed Deposit+”, Klarna relies on the modern integration into the app and strengthens this better conditions. But what can Fixed Deposit+ do? During the fixed term, interest accrues on the amount that customers invest – the money “grows” without you doing anything about it.

To be able to use Fixed Deposit+, you have to open a bank account in the Klarna app, which is done quickly, and deposit money from an external account. You then decide how much you want to invest.

There are no account fees neither for the Klarna bank account nor for fixed deposit+. This alone can set you apart from many competitors from the long-established financial sector. There is no minimum deposit, customers can save from the first euro, explains Klarna in a statement.

Through the Swedish deposit guarantee scheme Deposits protected up to 100,000 euros. The amount corresponds to the legal minimum standard in the EU. Great importance is also attached to security in the app: Biometric identification using fingerprint or face recognition is provided for access to the functions related to Fixed Deposit+.

What Klarna customers should know before opening Fixed Deposit+

Anyone who decides to invest in a fixed-term deposit account should know that customers usually cannot easily access their credit before the end of the term. So you should if possible be sure not to need the savings before maturity.

Here you can find out how you can save when shopping online:

In addition, 1.15 percent over four years is more than the competition offers – but that’s what the current status offers no adjustment for inflation. Over the course of the year, Klarna plans to integrate further “financial management features” into the app. We are curious.