Vinted, LeBonCoin, AirBNB… Do you have to declare your earnings to taxes?

Contents

What is the date for declaring your taxes online?

Tax filing season began on Thursday, April 13, opening up access to tax portals for taxpayers. As a reminder, here are the deadlines for submission:

- Monday, May 22, 2023 midnight for the paper version

- Thursday, May 25, 2023 for departments 01 to 19, as well as expatriates

- Thursday, June 1, 2023 for departments 20 to 54, including Corsica

- Thursday, June 8, 2023 for all other departments (55 to 974/976)

Declare occasional income online

The sums generated by occasional sales, in a private setting, are considered non-taxable by Bercy, as they depend on the management of personal assets. However, the absence of taxation is within a limit of €5,000 per sale. Once this level is reached, the capital gain is taxed at 36.2% (19% on the capital gain, 17.2% social security contributions). Furniture, cars and household appliances are exempt.

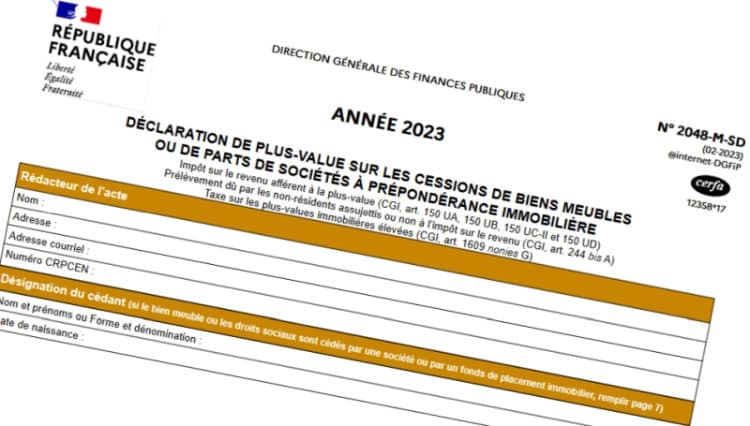

If you realize a capital gain, you must pay the amount in the month via the form n°2048-M.

I buy or manufacture goods for resale: how do I declare them?

If you buy products to resell them, or if you manufacture parts to offer them on platforms, then know that this is an activity, in the eyes of the State. You must then declare your income from these sales to taxes, depending on your tax system.

If your annual income is less than €176,200, then you have the choice between the micro BIC dietdeclarable via the form n°2042-C PRObenefiting from an automatic reduction of 71%, or the real dietwith a statement of the actual amount of expenses and revenues.

If your income is greater than €176,200, then you are automatically subject to the actual regime. You must then declare the amount of your receipts, via the form n°2031-SDbut with the possibility of deducting your expenses and the obligation to declare VAT.

Please note: the platforms declare for you!

Important information, be aware that since January 31, 2020, online sales platforms are required to communicate to the DGFIP the transaction information of each user who meets one of these criteria:

- Over €3,000 raised through sales on the platform during the year

- The user has made at least 20 transactions on the platform during the year

So don’t try to hide transactions on Vinted, eBay and others, the tax authorities are aware. Positive note all the same, this information does not give rise to systematic taxation!