New feature puts PayPal in the shade

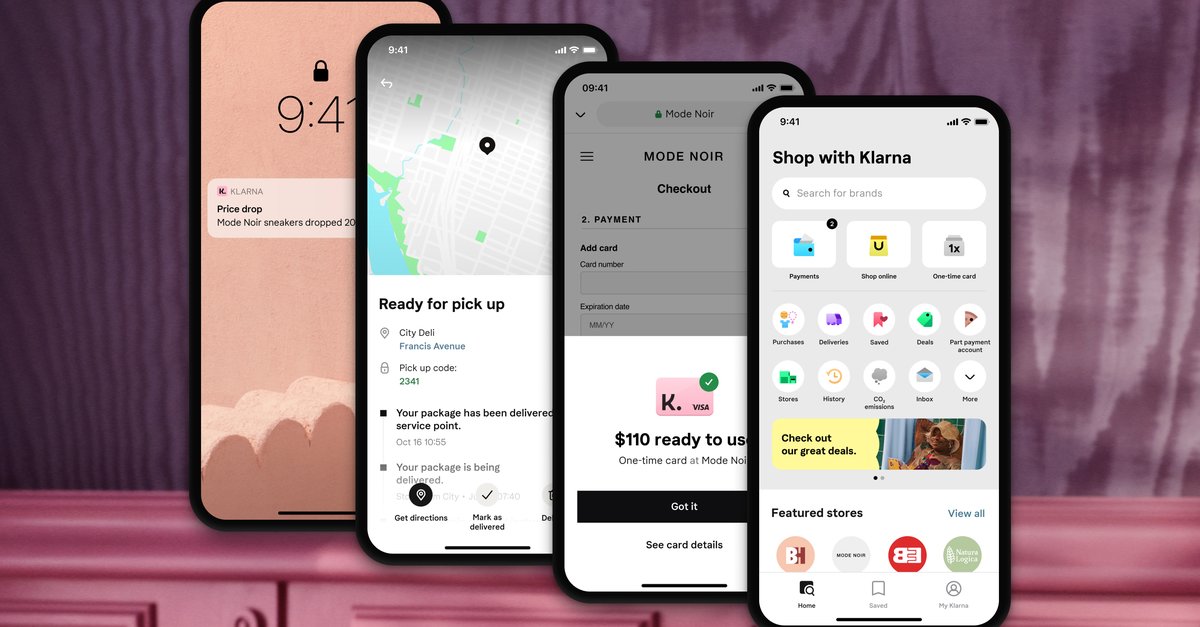

Klarna wants to become more customer-friendly. To this end, the company is revising its well-known finance app and introducing new functions. One easily beats PayPal’s offer while users save.

Version:Web

Languages:German

Klarna is leading the way: Interest-free installment payments are coming this year

Klarna has announced some changes that will benefit many users: payments via app should not only become more attractive, but Ultimately give customers a plus on the account. The new “Pay in 3” function will ensure this in particular.

Anyone who uses this revised installment payment automatically pays in three fixed monthly installments. In contrast to PayPal – and also to the previous installment payment from Klarna – no interest will be due. PayPal users, on the other hand, pay an effective interest rate of 9.99 percent when buying in installments. Although there are cheap loans elsewhere, the advantage of Klarna is that the function can be used in a particularly versatile way.

The last payment date at Purchases on account (Pay Later) will be extended from 14 to 30 days by default, this change applies immediately (source: Klarna). There is also no interest. The number of possible free payment reminders will also be raised to 6, and the reminders can continue to be sent via app, email or post, depending on the customer’s choice.

Klarna should also put an end to open-ended loans, which will be replaced by those with a fixed term and fixed payment rates. The paid function “pay in month X” will soon no longer be available.

You can also save money when shopping online with these tips:

Klarna wants to be a role model for PayPal and Co

Klarna’s steps are intended to save unnecessary costs and the Reduce the number of reminders. In Scandinavia and Great Britain, the changes had already been introduced in 2021. Since then, there have been 61 percent fewer invoices in Sweden, which have become more expensive due to reminder fees.

The “Fixed Deposit+” fixed-term deposit account with up to 1.15 percent effective annual interest is also new. Together with the innovations that have now been announced users have some advantages. The other changes are to be implemented in the coming months.

According to Klarna, they want to set an example in the industry that other providers could follow. In the message, the payment service provider advocates more transparency in the financial sector, so customers get more security. “We call on the industry to follow this example,” says Klarna CEO Sebastian Siemiatkowski.