Neobroker allows you to buy bonds

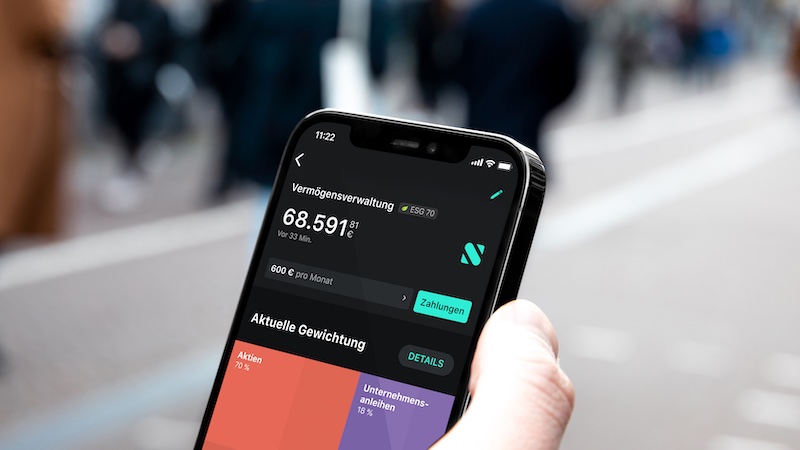

Scalable Capital now enables the purchase of bonds – as the first neo-broker in Germany. To start, users can invest in a Goldman Sachs bond, which promises an annual fixed interest rate of 3.1 percent.

The nebroker Scalable Capital now enables its users to buy bonds. To start with, a bond from the investment bank Goldman Sachs is available. That goes from the product website by Scalable Capital.

Buy bonds at Scalabel Capital

For a long time, there was no alternative to buying shares. But the current turnaround in interest rates is now bringing back an asset class for private investors. We’re talking about bonds that are now promising yields again.

With the fixed-interest bond from Goldman Sachs (WKN GX5LS9), Scalable Capital is therefore enabling its customers to buy bonds with immediate effect. The bond promises 3.1 percent interest over a period of three years. The neobroker issues them in pieces of 1,000 euros. The settlement takes place via the trading system Gettex – during the usual trading hours.

Open a depot with Scalable Capital now

How to buy bonds at Scalabel Capital

The bond can be traded free of charge via the Scalable Capital Prime and Prime Plus. In the free broker, an order costs 0.99 euros. In addition to the fixed interest, which is to be paid out annually, investors will receive their investment back after the three-year term.

Also, according to Scalable Capital, there is no minimum holding period. As always on the stock exchange, prices can fluctuate. Bonds are also subject to so-called credit and issuer risk. Because this is de facto a loan to the publisher.

Neobrokers and the turnaround in interest rates

In addition to stocks, ETFs, funds, derivatives and cryptocurrencies, bonds are now another building block in Scalable Capital’s portfolio. The neo-broker also wants to expand the range of bond maturities, types and issuers in line with customer demand.

The company has also been luring customers with 2.3 percent interest on overnight money since the beginning of 2023. However, the offer is only valid for Prime Plus subscribers. Competitor Trade Republic had previously made headlines with an interest rate of two percent. This is a little lower, but applies to all customers.

This article contains affiliate links for which we receive a small commission. However, these have no influence on the content of our contributions.

Also interesting: