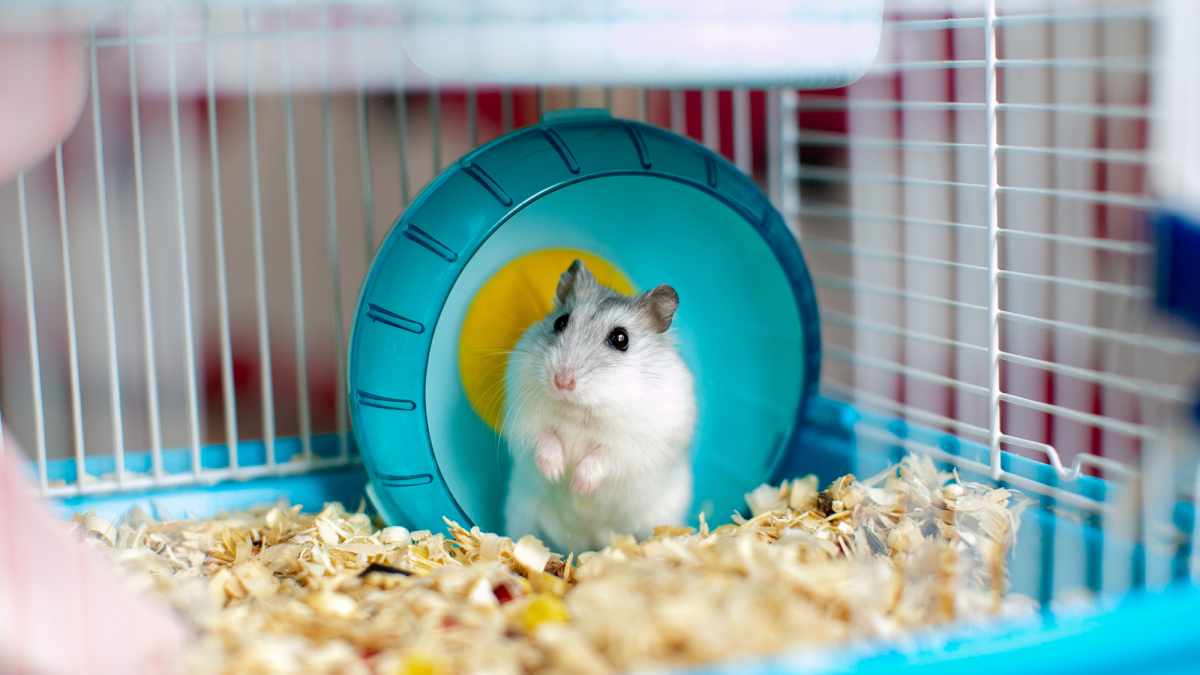

Hamster trades in cryptocurrencies – and is surprisingly successful with it

The hamster Mr. Goxx is by far the cutest crypto trader. In addition, the rodent is actually more successful than many of its human counterparts, at least at times.

Mr. Goxx has almost 4,500 followers on the video streaming platform Twitch. You can watch the hamster make his investment decisions. It works like this: Mr. Goxx has access to a hamster wheel through two tubes. If he enters the bike via the left tube, it is counted as an intention to buy. If he runs over the right tube, there is a sale. By turning the hamster wheel, one of 30 cryptocurrencies is then bought or sold by the hamster. This is done in 20 euro steps.

Mr. Goox has been actively, albeit unknowingly, trading in cryptocurrencies since June 12, 2021. So far with considerable success: As of today, his portfolio has grown by at least 19.41 percent. In the meantime, the rodent even achieved an increase of 50 percent, according to the crypto news site Protos. For comparison: The Bitcoin price had only increased 41 percent in the same period. Mr. Goxx was also able to overtake the S&P 500 stock market index in the comparison period.

According to Protos Despite his surprisingly good knack for crypto investments, Mr. Goxx has still not generated enough profit to recoup the original cost of his cage. Especially since the hamster, or its owner, has to pay taxes on the income generated.

In the end, Mr. Goxx is a hamster after all. Occasionally, he therefore buys cryptocurrencies only to sell them again shortly afterwards, which ultimately leads to many small losses. In addition, the rodent has of course only traded in cryptocurrencies for a relatively short time.

Basically, randomly selecting investment opportunities is not a good idea – especially when it comes to a long-term investment horizon. Interestingly, one came study from 2019, however, came to the conclusion that a random stock selection even pays off in theory for absolute newbies. But only because, according to the study, newcomers to the stock market tend to buy correlated assets.

The stocks bought may then come from different industries, but are often subject to very similar market movements. Accordingly, these investors would be even better off choosing their stocks at random to get a more diversified portfolio. In the end, it would of course be even better to find out about a sensible investment strategy in advance and to consciously build up a more broadly diversified portfolio.