Friend or scam? The Bling app does not help out for free!

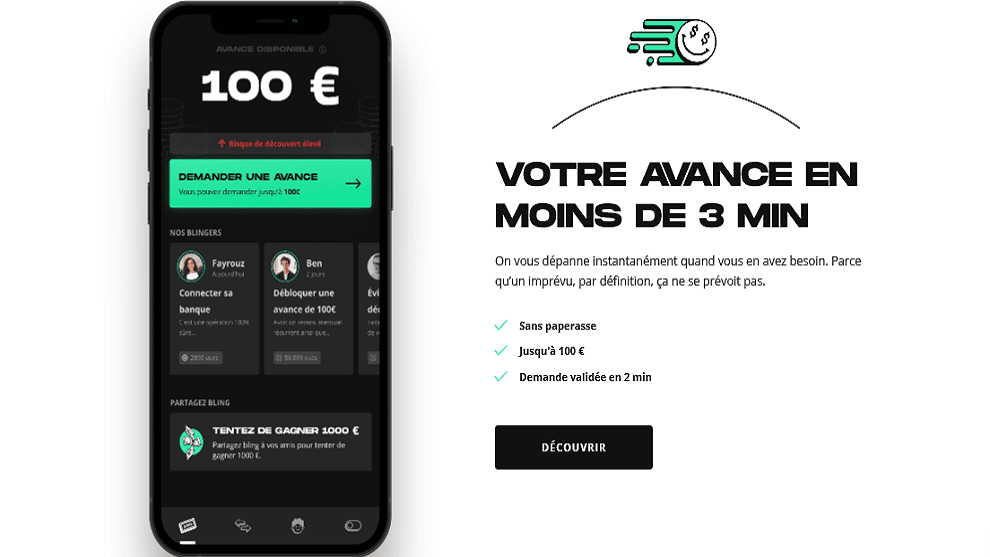

“Human, responsible, honest, cool” … When you go on the bling site, you almost feel like you are in communication with a friend who is there to help you out with a smile without expecting anything in return. He’s just there to help you if you have a bill to pay, a sudden urge to indulge yourself by buying new sneakers, or avoid an overdraft. Like Abbé Pierre des finances, in a few clicks, you can receive a sum of up to € 100 in your bank account in 10 seconds. For the refund, there is no problem, Bling will use it when you are bailed out. It’s cool, man, we’re not in the rush! These people just want to help you. By scratching the surface of this well-polished varnish a little, we realize that everything is not so “Abbé Pierre” as that.

Confidence reigns

Really, the folks at Bling, they know how to put you at ease. On the pages of their sites, tons of super benevolent phrases and reminders that they are very different from “those nasty banks who are thirsty for money monsters.” Example :

BLING’s mission is to help you be financially healthy. By supporting you in the event of the unforeseen without degrading the situation and by helping you to manage your budget well. Knowing what you’re doing is the best way to stay in control.

If it is not beautiful that! They even warn against ” micro-credits which worsen the situation, predators who watch for financial errors, APRs, EFTs, lending rates and other terms that hide their game “. Thank you very much, Bling, you are the benefactor we were waiting for to finally live a healthy life. Except that he does exactly the same as the others he pretends to despise, but with pastel colors and a colloquial way of talking.

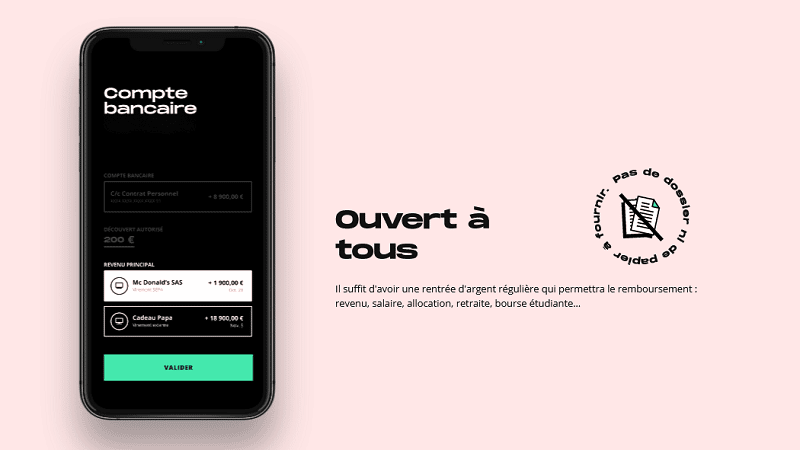

First, the loan is not ” open to everyone As Bling chants. Your account is indeed analyzed to see if you have regular cash inflows that will allow you to repay it. The amount loaned is then indexed to these same frequent positive transfers, so you don’t choose it. Everything is free ? No ! The gratuity is effective if you request the sum to receive it in three days or a week. On the other hand, to have it in the seconds to come, there is a fee of € 7, whether you request € 25 or € 100. It’s starting to make a pretty mind-blowing interest rate, right? We should also remember that the application is positioned to target above all those who are in urgent need of money! The palm of the cynicism goes to Bling’s warning against microcredit. Note that the application will analyze your bank account daily and that, as soon as the money runs out, she will send you an innocent “Anti red zone” notification. The right time to re-request a transfer from them? Machiavelli, get out of this body! And beware of the 8% penalty if you can’t pay on time. Sadly, Bling is not the only app of its kind in this market.

Let’s call a loan, a loan!

Because there is indeed Bling, but also Cashper and Floa Bank and they target above all young people for whom everything must go quickly without thinking of any further, but also those who cannot make “real loans” with banks. At the start of the year, UFC-Que Choisir had filed a complaint for ” deceptive marketing practices »Against these companies, denouncing the opacity of tariffs. It is true that the € 7 commission requested by Bling is not mentioned anywhere on their site. The consumer association also points the finger advertisements that soften the potential dangers of these credits :

There is a real problem with the advertising around these credits. Floa Bank disguises its “Helping Hand” like a scratch card when Bling claims that credit is “a good habit to take” to “maintain your financial health”.

UFC-What to Choose finally alert on the incredible interest rates of these loans, well disguised as fees to allow immediate payment:

They hide from borrowers the annualized interest rate on the loans they offer to obtain the advance within the announced period. Under these conditions, Bling, Cashper and Floa Bank blithely exceed the maximum authorized rate for consumer loans (from four to more than one hundred times). The palm of indecency goes to Cashper with a rate of 2234%.

UFC-Que Chooser files a complaint against Bling, Cashper and Floa Bank. These three organizations offer mini-credits on the internet. The UFC-Que Choosing consumer association denounces the opacity of their prices. https://t.co/PhNcdbWOzB via @Figaro_Economie

– Louise de Lannoy φ # JLM2022 🔻 (@LoudL) May 11, 2021

That these companies have to earn money to survive is quite normal, but why don’t they assume this commercial status? This world is really magical and there is a lot to worry about when you see how behave these greedy vultures sellers of powder with grimaced eyes as benevolent patrons offering happiness and YOLO.

This is also cynicism 2.0.