Ultimate Wallet available in Germany

Bringing the decentralized financial system (Defi) to the smartphone and letting you store your crypto assets yourself, these are the goals of the Defi wallet from the Berlin startup Unstoppable Finance. Its app was expected by many users. German crypto fans have been patient the longest, because the app has only been available here since today – with a delay of more than half a year.

The reason for the delay was the lack of a license from the German financial regulator Bafin. This also means that the version of the wallet app for the German market has lost many functions: German users cannot buy or exchange tokens. The company announced that talks with the supervisory authority would continue.

“While we largely understand Bafin’s arguments, there are defi-specific technologies that require a more nuanced approach and should result in adjusted guidance,” said Peter Grosskopf, Founder and CTO of Unstoppable Finance.

Staking, trading, storing NFT – there are countless providers and decentralized protocols for this. It is often difficult to identify which of these are trustworthy. Unstoppable Finance wants to solve this by pre-selecting providers for Defi services.

Ultimate is a mobile wallet that allows token trading and interaction with Defi protocols on the Ethereum and Solana blockchains. It is not necessary to disclose the identity in a know-your-customer (KYC) process.

“We want to become the robinhood of the defibrillator world,” says CEO of Wallenberg-Pachaly. With NFT and tokenized assets, the Defi-Wallet offers significantly more possibilities, but with a user experience that is similar to that of neo-brokers who bet on the stock market and cryptocurrencies.

“There are already many good wallets on the market. But for most people it is too much to find trustworthy protocols themselves,” says Maximilian von Wallenberg-Pachaly. He describes Ultimate as a safe space in the wild west of defibrillation services.

Ultimate wants to accompany users in the world of decentralized finance. (Screenshot: Ultimate/t3n)

Only checked and verified providers should make it onto the platform. The app is intended to allow users to navigate through the defibrillator world “as a co-pilot” and ultimately open it up to a larger audience.

The application has the following functions:

- Deposit fiat currencies such as euros

- Trading around 10,000 tokens via the exchanges Orca and Raydium (only outside of Germany)

- Direct investments in various protocols (Solana token staking and automated option strategies; outside of Germany only)

- keep NFT

- Cloud storage of private keys

- Solana and Ethereum wallet address tracking

The wallet runs on the Solana blockchain. However, an integration of Ethereum is planned. Ultimate is launched with four defi protocols that can be used via the app.

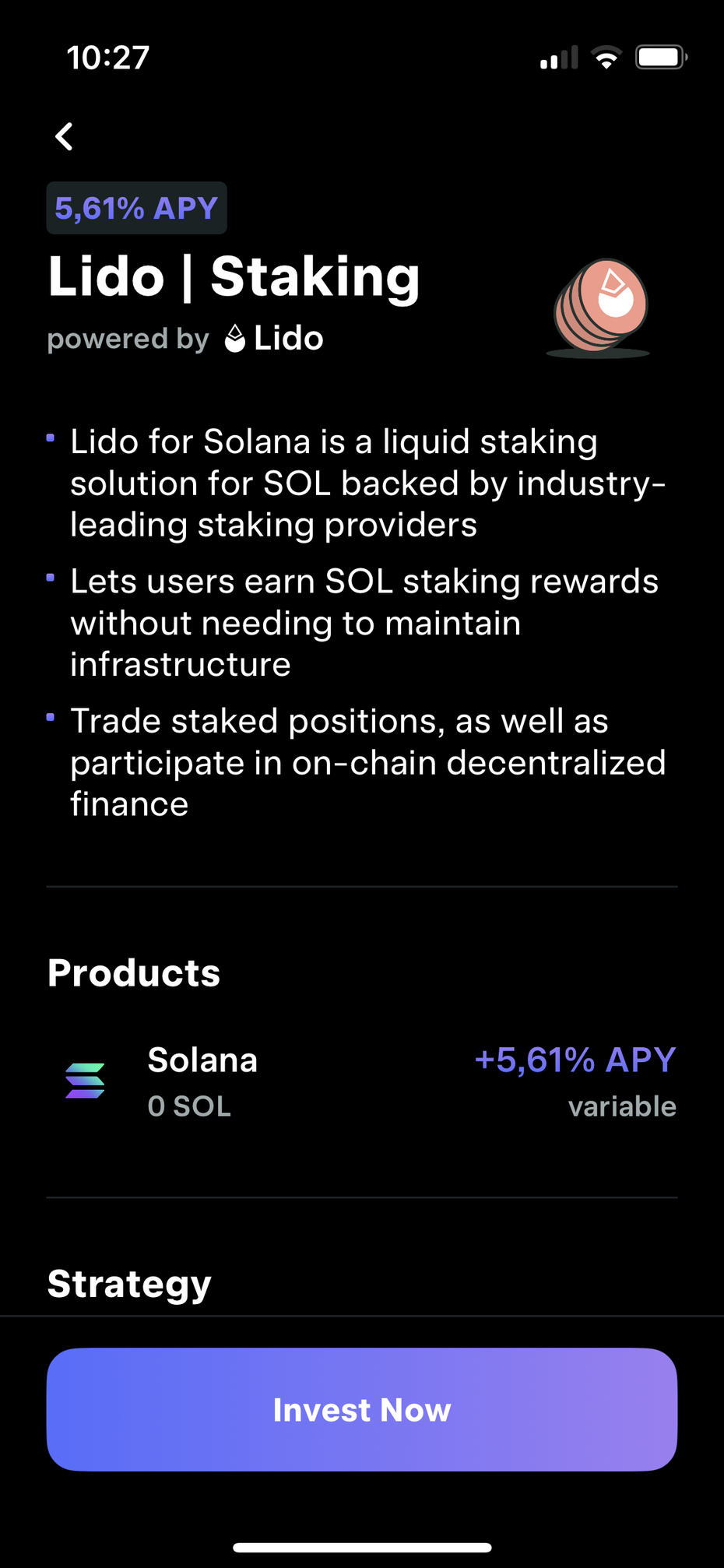

Staking is made possible, for example, by the provider Lido Finance, which promises a return of around five percent for staked Solana tokens. According to Ultimate, higher returns are possible with Friction Finance. This protocol is said to generate returns of 14 to 29 percent via automated options trading strategies.

Staking via the major provider Lido: The Unstoppable Finance app will soon include even more protocols. (Screenshot: Ultimate/t3n)

With the pre-selection of trustworthy protocols, providers and products, Ultimate wants to stand out from other wallets. On average, it takes four to six weeks for new providers and their services to be checked, says the CEO.

Criteria are the framework data such as company history, location and size, the services offered, the target group, the degree of decentralization and regulatory complaints. “We also rely on external audits and security tests and look at the risk profile,” says von Wallenberg-Pachaly.

Editor’s Recommendations

The app is currently available free of charge in Apple’s App Store and Google’s Play Store and, according to a spokesman for the company, will remain free of charge in the long term. For international users, there is a fee of 0.85 percent per swap. There are no fees for integrated Defi protocols. However, another source of income for Ultimate is kickbacks that some providers like Lido pay.

Ultimately, Ultimate should be an application for private investors. “We are currently in a crypto winter, so we are focusing on people who have had contact with Defi before,” says von Wallenberg-Pachaly.

The app is the first product of the Berlin fintech Unstoppable Finance. Maximilian von Wallenberg-Pachaly, Peter Großkopf (CTO) and Omid Aladini (Director of Engineering) are the founders of the fintech. Before that, the trio set up the Stuttgart Digital Exchange together. Her goal for Ultimate is nothing less than to build the future of finance.

In October 2021, the founders received funding of 4.5 million euros. They expanded their team to 25 employees and started developing the app. In August of this year, the founding trio received a further 12.5 million euros in order to continue growing. Lightspeed Venture Partners, among others, participated in this Series A financing round.

In the t3n test, the beta version of the app worked without any problems and scored with a logically structured interface. The wallet is set up quickly and the app supports biometric account protection via Face ID or Touch ID on the iPhone.

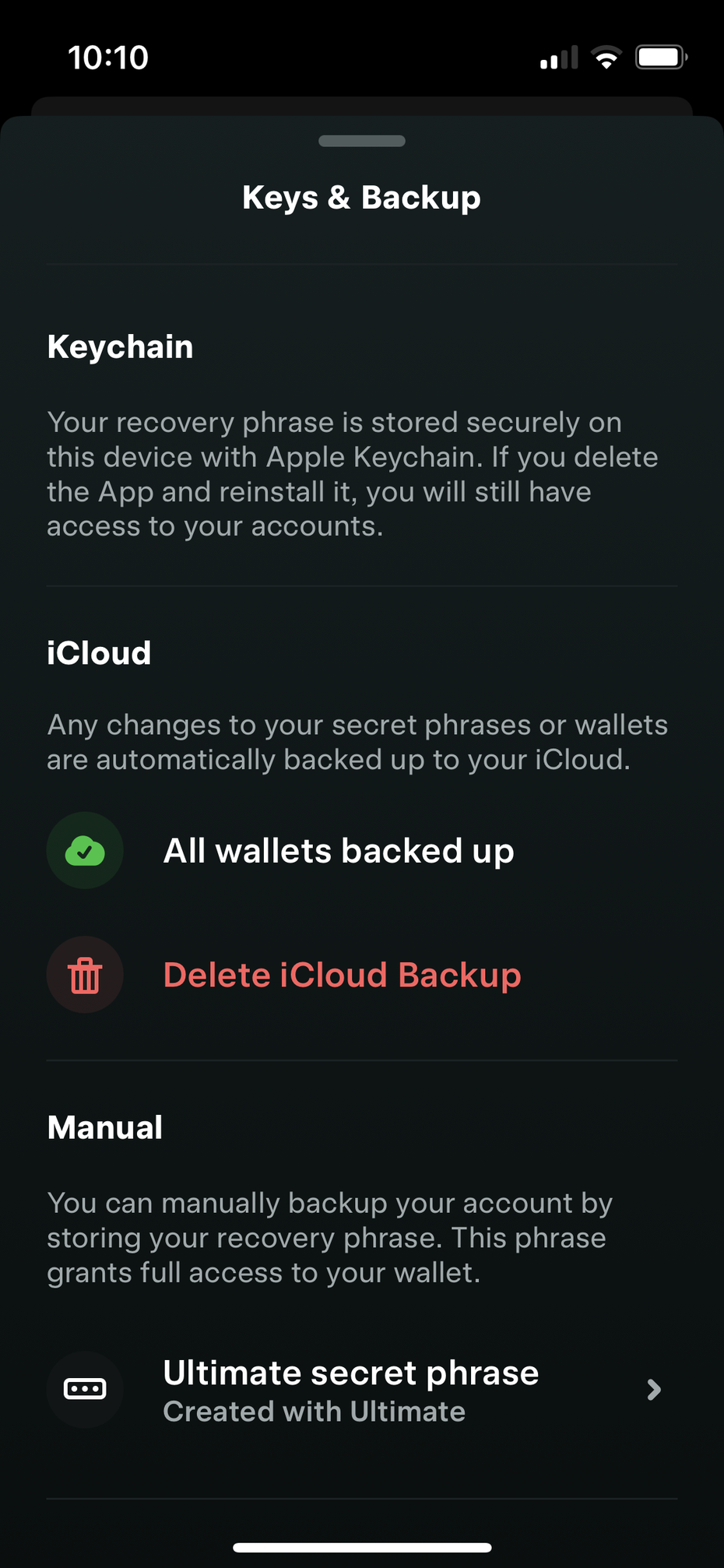

Store private keys in the cloud: A feature that unhosted wallets do not otherwise offer. (Screenshot: Ultimate/t3n)

The advantage to other unhosted, i.e. self-managed wallets is obvious: the possibility to save the private keys. This works with the iCloud and is done with one click. Alternatively, users can also generate security phrases and save them offline.

A major drawback for German users are the limited functions of the wallet. While they can keep their crypto assets in the wallet, they cannot buy new tokens or exchange tokens for others. For this, German users are still dependent on other exchanges.

The investment options are still very poor given the variety of protocols in the Defi area, even with the full range of functions. There is also some catching up to do with the promised multi-chain approach. So far, the app has been running on the Solana blockchain, a project that experts criticize for a lack of decentralization and dropouts.

Another drop of bitterness is the payouts: So far, a cash-out, i.e. a payout of crypto assets in fiat currencies such as euros, is not yet possible via the app. To do this, users would have to transfer their tokens to a central exchange. According to Unstoppable Finance, however, the plan is to integrate a payout option for early 2023.

Even if the app still leaves a few wishes unfulfilled: the app could become a good choice for Defi beginners, especially because of the “child safety” aka cloud storage for the private keys.