The top topics in affiliate marketing

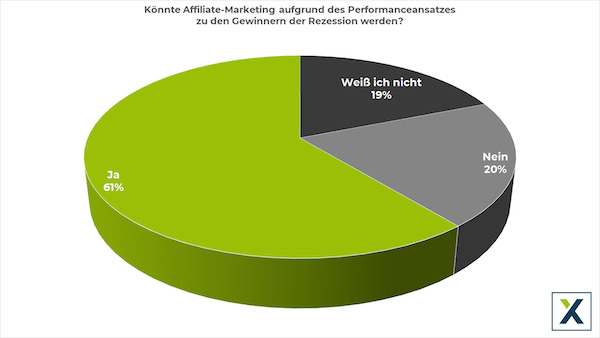

Affiliate marketing could become one of the winners of the crisis in 2023. That was the result of a survey of 1,000 marketers. But what opportunities, risks and challenges are the industry dealing with? We will examine this in a three-part series. Part 2 of 3: Cookieless Future, Performance Measurement and Mobile Tracking in Affiliate Marketing 2023.

In 2023, too, the affiliate industry will support the further development of attribution and performance measurement. According to the Affiliate Trend Report 2023 the topic Cookieless Future the top trend topic for 2023.

Contents

- 1 Cookie content, ePrivacy and TTDSG are now state of the art

- 2 The majority of advertisers already use first-party and server-to-server tracking

- 3 Development and expansion of MarTech solutions and decline in the use of customer journey tracking

- 4 Affiliate Marketing: Lack of mobile tracking one of the biggest problems for 2023

- 5 Tracking and Cookies in Affiliate Marketing 2023

Cookie content, ePrivacy and TTDSG are now state of the art

While the topics of cookie content, ePrivacy Regulation and TTDSG were still mentioned as the top trends in recent years, they are now considered state of the art and are therefore only considered trend topics by a few advertisers and affiliates seen.

However, evergreen topics such as attribution and customer journey tracking, ad blocker problems and cross-device tracking will continue to be among the most important trend topics for 2023.

At the same time, for 62 percent of the affiliates, the browser sanctions against tracking technologies, as well as data protection regulations with 43 percent and the blocking of tracking cookies with 41 percent are the three top problems for 2023. That is why 62 percent of the affiliates also wish secure 1st-party tracking from the advertisers.

The majority of advertisers already use first-party and server-to-server tracking

The good news, however, is that more and more advertisers are taking action and switching to the current offers of affiliate technologies for measuring performance. 45 percent are already using first-party tracking and server-to-server tracking.

Another 7 percent use first-party tracking via container tags and 3 percent use real first-party tracking on a subdomain basis. However, the proportion of advertisers who still use outdated third-party tracking is unfortunately still too high at 35 percent.

Nevertheless, the affiliate industry is well positioned for the post-cookie era and offers all future-oriented alternatives for measuring performance. For 74 percent of the advertisers, server-to-server tracking in particular, and for 41 percent first-party tracking, is the model of the future in order to be able to continue to reliably map sales attribution.

Nevertheless, the industry should not just rest on the laurels of the latest technologies, because at the moment no one can predict exactly how long browsers will continue to accept first-party tracking and whether there might be regulations or restrictions here in the future.

For example, Firefox has already started to roll out the Total Cookie Protection, which was first introduced in February 2021, in “Normal Mode”, i.e. it then takes effect by default. In addition, Firefox has removed tracking parameters from various providers’ URLs with version 102, even if the identifiers of the major affiliate networks have not yet been affected.

Therefore, further alternatives will be needed in the future. For example, companies could develop their own identify strategies and data collaborations as part of a broader first-party data setup. Recently reported the OMR already informed that Vodafone is currently testing a new tracking solution with Trustpid.

Apparently, several mobile phone companies currently want to make advertisers an offer to use Trustpid to display targeted advertising to consumers based on their mobile phone number. Such mechanisms could be a solution for large corporations and industries in the future, but certainly not for small and medium-sized online shops, which do not have the capacity for this. Nonetheless, the approach is interesting.

Development and expansion of MarTech solutions and decline in the use of customer journey tracking

The demands on marketing managers are constantly increasing due to the topic of cookies. In order not to lose touch with the competition as retailers and shop operators, advertisers should work on the further development of their MarTech solutions and question themselves as to whether they are future-oriented in terms of their technologies.

According to the Affiliate Trend Report 2023, 29 percent of advertisers are now using a customer data platform (CDP) such as econda, CrossEngage, Exponea, Tealium or mapp Cloud to aggregate data from different data sources. Another 29 percent plan to use a CDP in 2023.

However, 59 percent of the advertisers do not yet know the current Customer Lifetime Value (CLV) of their affiliate customers and a further 41 percent cannot yet determine how often customers have made purchases who were referred via affiliates.

52% of advertisers already collect first-party commerce data such as email addresses, purchase history or loyalty status in order to continue to reach consumers in a relevant way in the future without violating privacy. The big advantage of first-party data is that it comes directly from the users and is voluntarily disclosed if they see an advantage in it.

Therefore, companies must first make it palatable for customers to disclose their data. Because companies’ own first-party data will be the new gold currency in the future. In a so-called data clean room, i.e. an infrastructure used and protected by several partners, first-party data is processed anonymously and encrypted and checked for overlaps, without the partners involved being able to see the original data.

In order to be able to measure users and sales across devices, 31 percent already use cross-device tracking from providers such as Piwik Pro, CrossEngage, Google 360 or emetriq. Another 18 percent are planning the integration for 2023. Only 14 percent are currently using customer journey tracking.

Affiliate Marketing: Breaking down silos to serve customers

Here the use has decreased enormously compared to 2021, when it was still used by 45 percent of advertisers. In 2020, it was still being used by 54 percent of advertisers. The reasons given by the advertisers are the complex technical implementation (56 percent), the lack of time to take care of it (45 percent) and internal political reasons (44 percent).

However, for many companies the selection of the right technologies is still complex and time-consuming, since the market is now flooded with different small-scale solutions and companies are increasingly losing track of which they actually need and which they don’t.

The market currently consists of up to 10,000 different applications. Nevertheless, the need to improve processes through digital skills, especially in sales and marketing, should be one of the most important goals for companies. However, this requires real creative will on the part of the advertiser, among other things, silos have to be broken down in order to be able to serve customers holistically.

A survey of 1,500 marketing managers and board members found in the “Marketing Tech Monitor 2022“ that the market volume for MarTech in Germany between 2021 and 2026 from 4.2 billion to 10.7 billion. euros will increase.

Affiliate Marketing: Lack of mobile tracking one of the biggest problems for 2023

With regard to the increasing importance of mobile traffic, the topic of mobile tracking will also remain relevant. In the affiliate network Awin, the implementation of app tracking has increased by 578 percent since 2020. In 2021, 73 percent of all eCommerce sales were already completed via a mobile device.

Mobile commerce sales have more than tripled since 2016, and smartphone usage is also expected to increase by 13 percent this year. Black Friday 2022 also confirmed this once again, as the most popular device for online shopping was clearly the smartphone, which accounted for 52 percent of sales in the Awin network.

Tracking and Cookies in Affiliate Marketing 2023

It is interesting that the highest AOV of 139 euros was generated via the tablet – this has increased by 36 percent year-on-year. In the Admitad affiliate network, 72 percent of sales were made on smartphones on Valentine’s Day alone. In 2021 it was still 56 percent.

Nevertheless, 27 percent of affiliates still see a lack of mobile tracking and 25 percent a lack of cross-device tracking as the biggest problems for 2023, and 38 percent of affiliates also want cross-device tracking for the device in 2023 -Overarching allocation of sales from your advertisers.

Therefore, measuring mobile sales should actually be an integral part of every affiliate program these days, because the advantages are obvious. According to Awin, on average, advertisers see significant increases in various KPIs and increases in sales and revenue just two months after implementing mobile tracking.

Average cart values also increased by 15 percent for advertisers after implementing app tracking compared to the previous period. In any case, it should not fail due to technologies and providers. Because mobile measurement partners (MMPs) such as Branch, Adjust or Appsflyer enable advertisers to receive reports across multiple campaigns and channels.

And publishers such as Klarna, TopCashback or Quidco are also continuously developing their app offerings in order to benefit from the rapidly growing mobile market.

Also interesting: