Tatra banka: Choose the version of the application and pay securely

The Tatra banka application no longer needs to be introduced to anyone. This is an excellent helper with whom you have an immediate overview of your finances. The upgraded application brought the choice between Lite and Full versions.

Contents

A lightweight application may come in handy

The main reason for the light version of the application is better overview and simplicity. If you are one of the users who use only the basic functionality of the application, it will be made for you. You’ll quickly and easily find exactly what you need for day-to-day financial management.

The bank’s data showed what functions clients use most often in the application. It’s checking your account balance, making a payment, and checking to see if your money has successfully left your account.

Quick, easy and convenient

The home screen of the Lite version of the application is adjusted accordingly. This means that it is precisely these most used elements that dominate. A welcome change is the accelerated entry of payments in just a few clicks, which will surely be appreciated by many clients.

Although it is a light version of the application, it still offers all the necessary features. It is also worth mentioning, for example, the new section called Bank, which provides an overview of the most used products in the client, such as accounts, account savings and loans. Of course, you can manage products, change names and settings, as well as request a new account, savings or loan.

Use the version of the application that suits you

Can’t decide which version of the application to choose? You don’t have to worry. Just try both and in time you will see which will suit you better. You can change the application versions at any time in the settings.

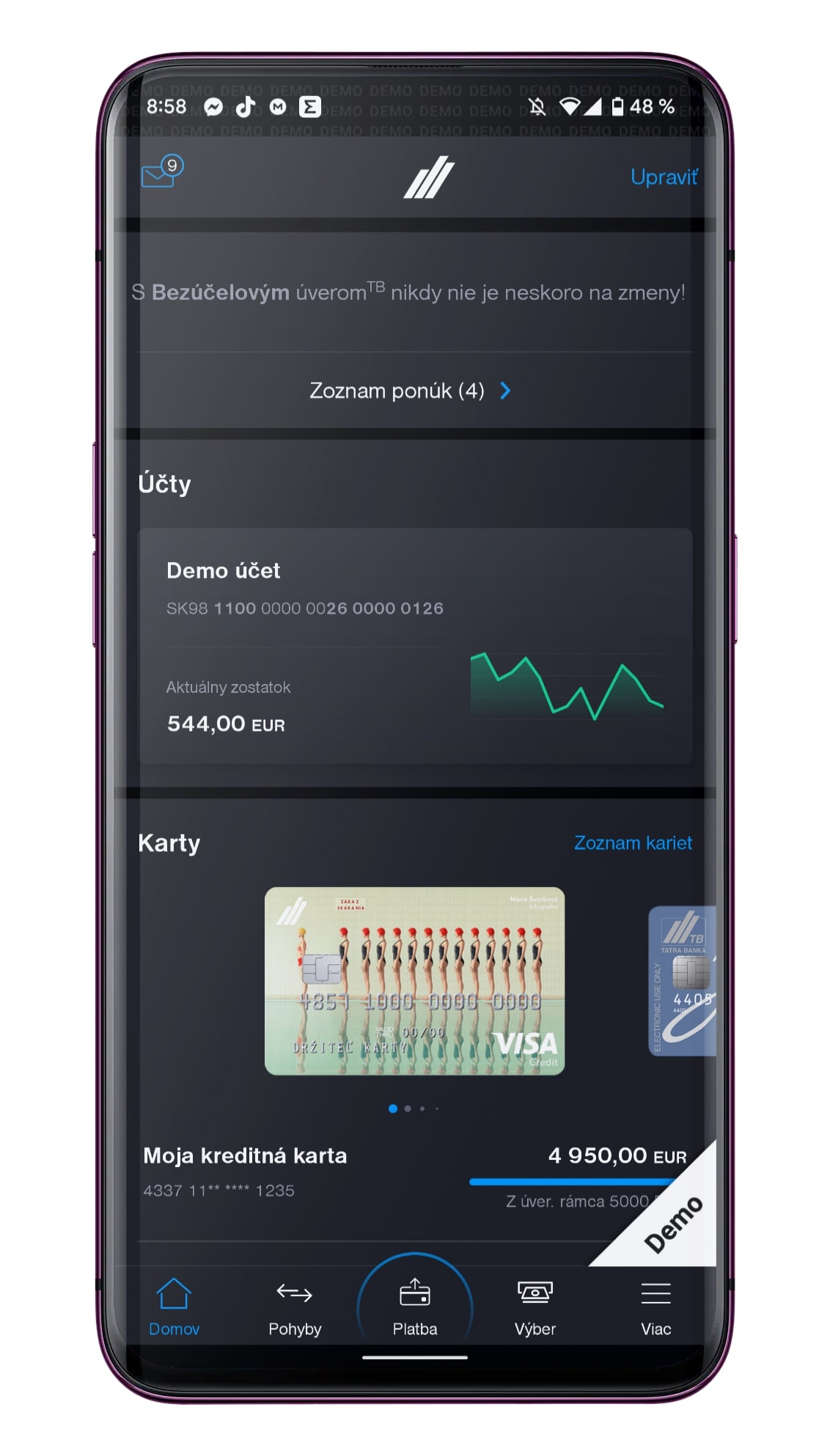

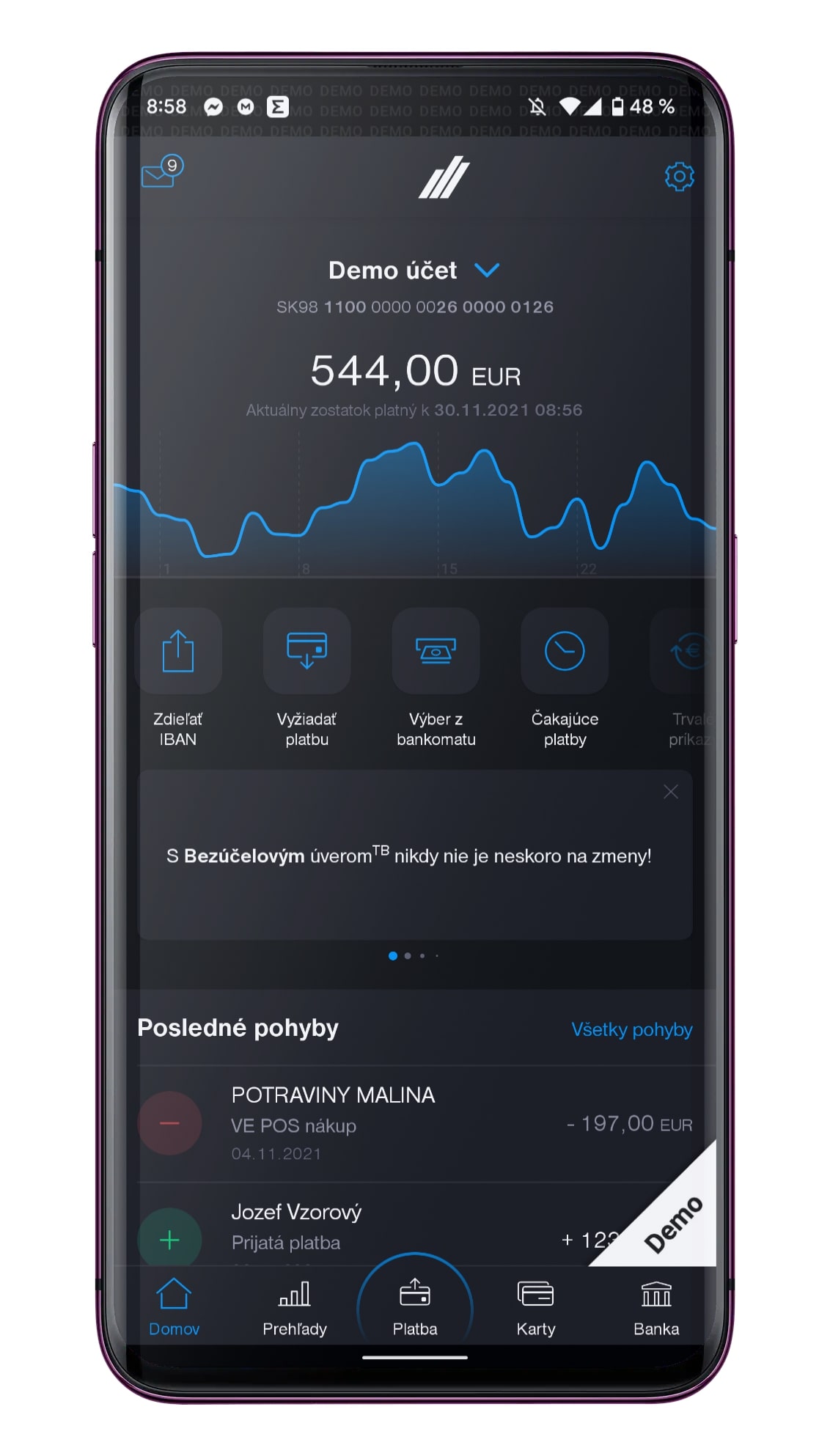

Home screen full version Source: Miroslav Schwamberg

Home Screen Lite Version | Source: Miroslav Schwamberg

Christmas shopping is easy and safe

No matter which version of the application you use, it also offers other useful features that you will use even now, in the run-up to Christmas. The share of online sales has increased significantly recently, and 2021 is no exception. Quite the opposite. People are shopping online more and more. Sometimes they don’t even realize that on the other hand, a cheater may be lurking.

We report various types of online fraud quite often. The main problem is online payments, where an attacker can lure data from the card and then misuse it. Tatra banka’s clients have an important advantage in this area. In both versions of the application, they can easily generate a one-time payment card number and pay for their ordered goods online. They do not have to worry about their card being misused.

If the attackers managed to capture the information from the card in some way, they would not be able to rob the customer of the money. Such a one-time card cannot be used repeatedly. The client always generates a new number for each purchase.

Limits are a great prevention against online theft

The so-called limits are an important prevention against abuse. The client can set these limits in the application with a few clicks exactly according to their ideas. He has three options to choose from.

The first is maximum limitwhich represents the total daily limit of the card. Cash limit is intended for cash withdrawals and the third is internet limitwhich is an ideal tool for secure online shopping.

If you are shopping online, the ideal way is to have the limit set at € 0 and operationally increase it to the required amount of payment before making a purchase. After the purchase, you can simply reduce it again.