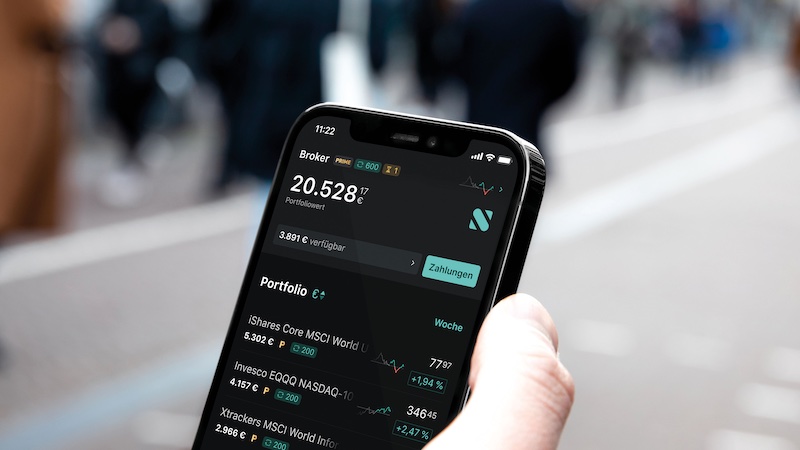

Scalable Capital lures with 2.3 percent interest on call money – with a catch

The Neobroker Scalable Capital is currently enticing with the “highest overnight interest rate in Germany”. The company promises a whopping 2.3 percent interest on the call money, outperforming the competition. But there is a catch, because not all customers benefit from the campaign. The backgrounds.

Contents

2.3 percent interest on call money at Scalable Capital

Trad Republic recently caused a stir with high interest rates. Because the Berlin Neobroker promises all its customers two percent effective annual interest on their assets. Now the Munich competitor Scalable Capital is following suit and even overshadowing its rival – at least partially.

According to official announcement The Neobroker even promises 2.3 percent interest on the credit balances of its customers. The offer should therefore apply to both new and existing customers from February 1, 2023 and “until further notice”. Compared to the competition, however, there is a crucial catch.

Interest on the daily allowance: The differences between Scalable Capital and Trade Republic

In the future, Scalable Capital will pay interest on credit balances of up to 100,000 euros, while Trade Republic only has 50,000 euros. However, the Berlin neobroker pays its customers the call money interest monthly. Scalable Capital meanwhile speaks of a payout that should take place quarterly.

But the big difference is another: Because the 2.3 percent interest at Scalable Capital is only reserved for customers who have taken out a paid “Prime Plus” subscription. Membership enables you to trade shares and savings plans free of charge, but costs EUR 4.99 per month.

Zinzschlacht: Still a challenge to the competition?

The campaign can still be understood as a declaration of war on the competition. Background: Several banks have recently increased their interest rates. Because the European Central Bank (ECB) has previously gradually raised the key interest rate as a result of the high inflation.

Both neobrokers are likely to aim to win new customers with their actions. However, all customers benefit equally from Trade Republic, while Scalable Capital hopes above all to conclude new paid subscriptions. And the company makes no secret of this:

Scalable Capital vs. Trade Republic: Will the interest rate offensive ensure more transactions?

“We make PRIME+ membership so attractive that it’s almost irresponsible not to become a member,” he said

Erik Podzuweit, Founder and Co-CEO of Scalable Capital. The interest rate offensive of the two fintechs could mean more transactions.

Because: Once the brokers have credit balances due to the interest rates, the probability of impulse purchases increases. This could also cause prices to rise, with some customers even beating interest rates with their investments.

Also interesting: