Account holders do not have to accept this

Interest rates are coming back bit by bit, but inflation is still tearing deep holes in many wallets and messing up account balances. If the bank then puts additional pressure on them to accept new contract terms, it can sometimes become too much for the customer. A dish will now jump to your side.

Price increase without approval: court puts a stop to Sparda-Bank

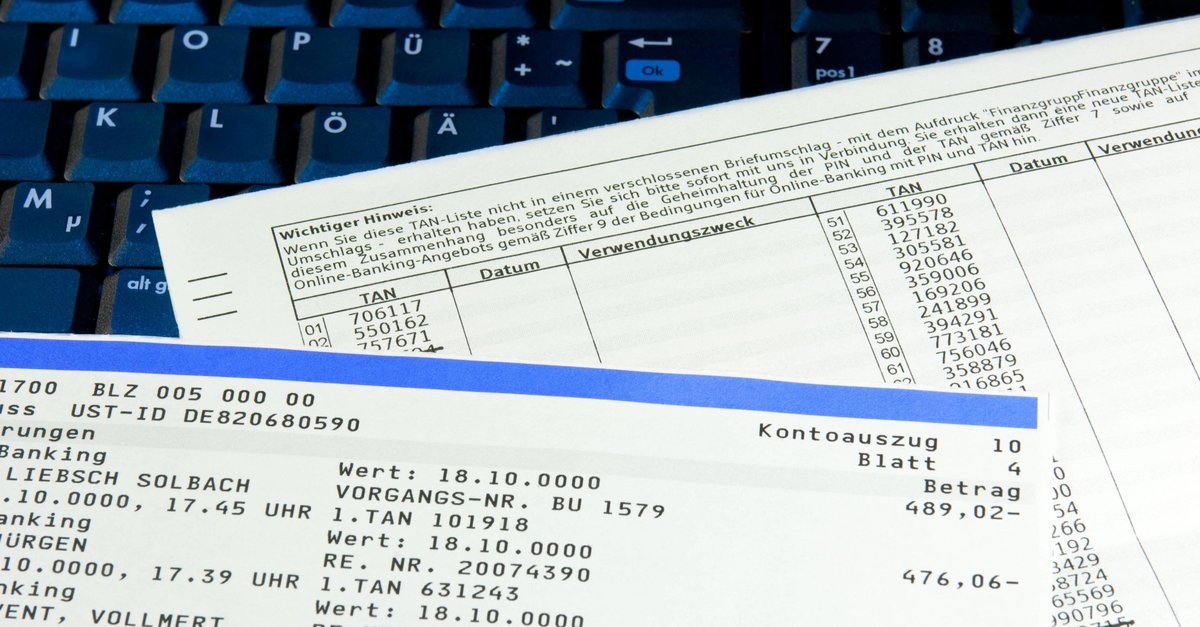

Since a ruling by the Federal Court of Justice (BGH) in 2021, it has actually been clear: banks must obtain the active consent of their customers for significant contract changes. But that has apparently not penetrated to all financial institutions. The Sparda-Bank Hanover has informed some customers in a letter that the further use of their accounts – for example through transfers or when withdrawing money – take as approval if these contractual changes should not have been approved beforehand. The district court of Hanover has now canceled this procedure in a temporary injunction.

In May and June 2022, the bank announced contract changes and asked its customers for their express consent. Account holders who did not do so received another letter in September: If the account was used further, Sparda-Bank Hannover would also consider this as approval. Banks must obtain customer approval for significant changes. These include, for example New prices.

Consumer advocates have therefore turned to the court: “If a bank needs approval for a contract change, the mere continued use of the account is sufficient for this dby customers – for example through a transfer or a cash withdrawal – not from”said David Bode, Legal Enforcement Officer at the Federation of Consumers (VZBV).

The court in Hanover sees it that way too. The accusation: Sparda-Bank acted aggressively, violated contractual principles and thus theirs customers disadvantaged. In addition, one acted clearly against the decision of the Federal Court of Justice.

This is how you are on the safe side with online banking:

Tacit consent is obsolete

The decision from Hanover should on the one hand Signal effect for the industry have: The fact that banks can claim tacit consent no longer works. On the other hand, the injunction is not directly applicable to other cases. It is therefore also unclear whether it can be transferred to terminations, for example. They had promised other money houses if customers did not agree to contract changes.