“A bank collapse would be much faster with the digital euro”

He is a self-confessed Eurosceptic and is considered a rebel in his own party: Frank Schäffler is a member of the Bundestag for the FDP. He is part of the budget and digital committee. But the 53-year-old is also very concerned about financial policy.

We spoke to him about his enthusiasm for Bitcoin and what the future of the crypto industry is with the planned regulations from Germany and the EU.

t3n: They’ve been championing crypto for years. Where does your belief in the subject come from?

Frank Schäffler: I am a follower of Friedrich von Hayek. As early as 1946, the winner of the Nobel Prize in Economics wrote that we should “denationalize” money so that there is competition between state and private money. I find this thought fascinating.

Most of us are only familiar with national currencies such as the euro or the dollar. Why is it important that there is private money?

Private money that is not issued by state central banks would ensure more competition. And through competition, inexpensive and good solutions are created for the user. There is currently private money such as cryptocurrencies, but real competition between Bitcoin and the euro is not yet possible.

Frank Schäffler (FDP) sat in the Bundestag for the first time in 2005. (Photo: Studio Kohlmeier, Berlin)

What are the disadvantages of the euro and the state monetary system?

Our monetary system is over-indebted. Central banks can create money out of thin air by printing cash. Central banks also control interest rate policy. Our banking system is very unstable, as we can see from the 2008 financial crisis and now from the Credit Suisse bailout.

Our banks, the central bank and the states are interdependent and help each other in times of need. This is an oligopoly of power with significant disadvantages. Private money could break up the oligopoly, because in a competitive monetary system the state could no longer get into debt so easily, which would make its currency less attractive.

Is bitcoin good as a competitor for the euro?

I can’t say that definitively. Bitcoin is certainly the first large-scale experiment. Because it was the first cryptocurrency to emerge as an answer to the financial crisis and as an attack on the state money monopoly. But there are still a few obstacles, because the state is trying to discriminate against private money.

Discriminate?

Yes, the state makes it more difficult to use Bitcoin, for example by making it compulsory to accept the euro. State bodies only know this one means of payment, to which there are no alternatives when citizens have to pay taxes or broadcasting fees. We can only agree on Bitcoin as a means of payment in private, but then increases in value are discriminated against because we have to pay taxes on them.

A lot is happening in the crypto sector: With the MiCAR, TFR and the eWPG, several European and German regulations are on the way. How will regulation affect the crypto industry in the coming years?

It will change very significantly. In the future, securities will probably only be issued electronically to a large extent, perhaps also on the blockchain. With the MiCA regulation for Europe, there will be the first regulated crypto market in the world. This will give the crypto industry and applications a significant boost. In Germany, we are already well positioned in terms of regulation. However, there is still a lot of ambiguity in terms of taxation.

Editor’s Recommendations

Digital central bank money has been discussed for years. How could a digital euro affect our monetary system?

Digital central bank money is the state’s attempt to keep up: The trigger was Facebook’s plans to create a digital currency with Libra or Diem, but the Facebook project has now been discontinued. This could also be the case for the digital euro. It’s technically difficult for the portly central banks to implement, and at the same time I don’t see any real benefit for consumers.

A digital euro is like open-heart surgery in our monetary system.

The ECB promises secure, electronic payments. What is your criticism of it?

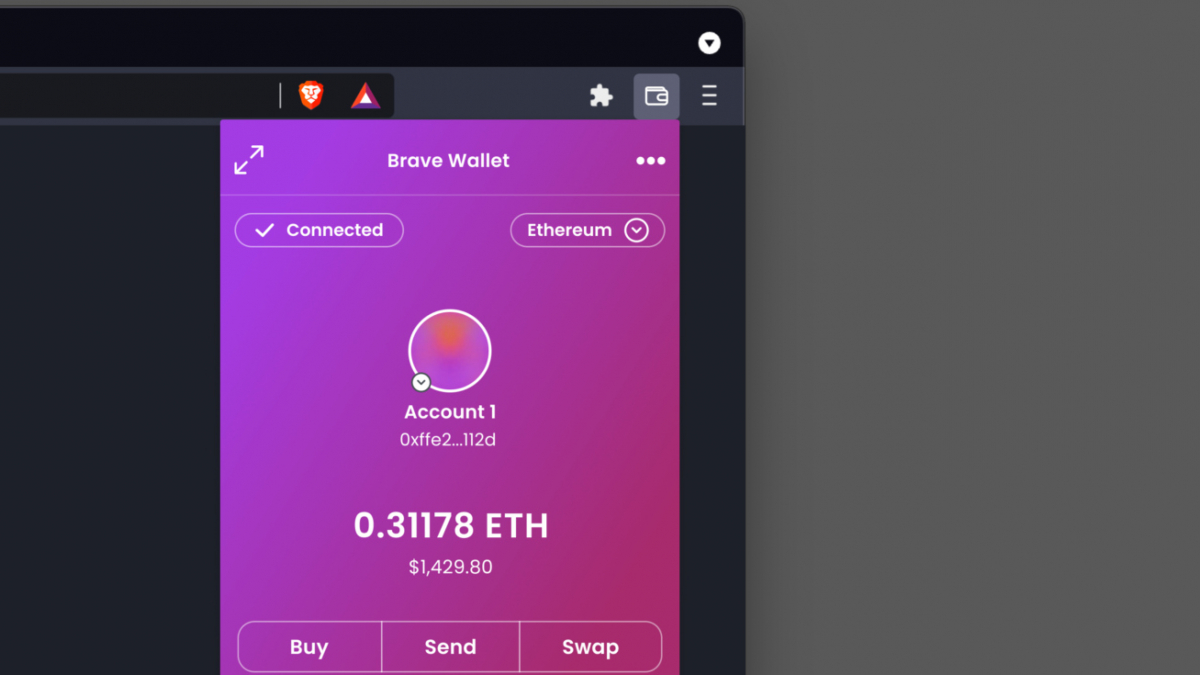

Yes, that sounds good for the average consumer. But a digital euro is not just progress, it is like open-heart surgery in our monetary system, because it promotes instability in the monetary system. Digital central bank money would be a third form of money alongside cash and book money. Each of us would have a wallet with digital euros on our cell phone, the availability of which is guaranteed by the central bank. In a banking crisis, each of us would quickly transfer our money from the bank account to the wallet – a bank collapse would then be much more possible. This is of particular concern to the banks, which are skeptical about the digital euro. In addition, the central banks have not yet made it clear what is supposed to be special about digital central bank currencies. Not programmable, central, high data protection and only a maximum of 3,000 euros per wallet are currently under discussion, but the central bank has not yet answered many specific questions.