Decrease in customers of mobile services and also revenues

Slovak mobile operator Orange boasted of the financial results for the last quarter of last year. His revenues fell year-on-year, as did the number of customers for mobile services, but on the contrary, the number of customers for TV services and fixed internet increased sharply. The operator claims that he has succeeded in fulfilling the strategic goals.

We consider the greatest success of the past year to be that in difficult crown times we put the health and connectivity of our customers, employees and partners in the first place, which we also managed to ensure. At the same time, the year 2020 was marked by a significant expansion of the availability of our services. We have succeeded in becoming a market leader in the quality and coverage of a mobile 4G network, in optics coverage, whether through our own network, via bit stream access or through a network sharing partnership agreement, as well as in digital television coverage. Thanks to the availability of services and attractive offers, we have successfully succeeded in gaining new customers of fixed internet, TV services and convergent services. More than ever before, customers have become aware of the importance of communication services in everyday life, especially their quality and reliability.

Federico Colom, CEO of Orange

Weak sales of terminal equipment accounted for a major share of lower revenues

Last year, the Orange operator had to deal with problems caused by the coronavirus pandemic, as well as other companies not only in Slovakia. As a result, total revenues fell by 2.7% year-on-year, while the year-on-year decline in revenues in the last quarter of 2020 was 1.9%. Revenues in the last three months of 2020 amounted to EUR 144 million.

The best-selling smartphones in Orange for January 2021:

The company’s total revenues as at 31 December 2020, reported in accordance with IFRS 15, amounted to EUR 541 million. According to the operator, the main contributor was the decline in revenues from terminal equipment sales. For the whole year it was a year-on-year decrease of 6% and for the last quarter even 7%. However, the operator claims that it achieved a better EBITDAaL margin thanks to effective management of direct and indirect costs.

|

Financial indicators (EUR million) |

Q4 2020 |

Q4 2019 |

year-on-year quarterly change |

k 31.12. 2020 |

k 31.12. 2019 |

year-on-year change |

|

Total revenues |

144 |

147 |

-1,9 % |

541 |

556 |

-2,7 % |

|

revenues from services |

109 |

109 |

0,0 % |

424 |

432 |

-1,8 % |

|

equipment revenues |

35 |

38 |

-7,3 % |

117 |

124 |

-5,8 % |

|

EBITDAaL |

n/a |

n/a |

n/a |

196 |

198 |

-0,7 % |

The coronavirus pandemic has increased the number of fixed internet and TV customers

As of 31 December 2020, the mobile operator had a total of 2,552,000 mobile customers, which is 8% less than a year ago. The number of customers of billed services and customers of prepaid cards decreased the most. The operator justifies this by clearing the portfolio of voice flat rates and deactivating the so-called sleeping packages. However, the numbers among mobile customers increased customers of M2M services. Overall by up to 59%.

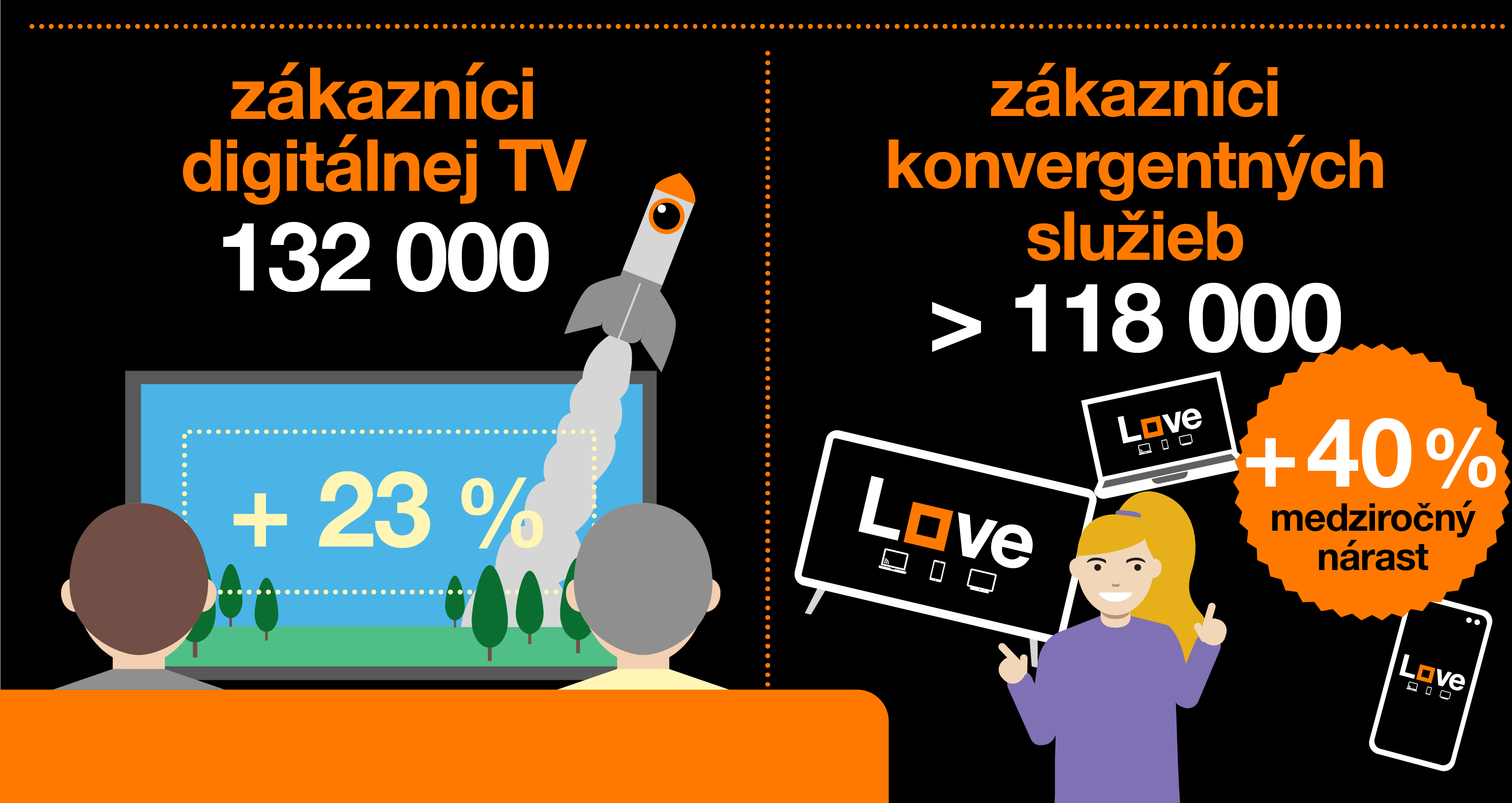

However, the mobile operator Orange was able to benefit at least from the coronavirus pandemic, during which the majority of the population had to be at home. Thanks to home office, the number of fixed internet customers rose to 250,000, which is 25% more than a year ago. At the end of the year, 132,000 customers used Orange’s TV services, which is 23% more than a year ago. There were 118 thousand customers of converged services.

While 84,000 customers from the competition passed to Orange last year, up to 91,000 of its own customers missed it. Nevertheless, the customers of this operator were able to transfer 43.81 mil. GB of data in a 4G network, which represents a year-on-year increase of 52%.

|

P customer numbers (in thousands) |

k 31.12. 2020 |

k 31.12 2019 |

year-on-year change |

|

Mobile customers |

2552 |

2775 |

-8 % * |

|

customers of invoiced services |

1942 |

2230 |

-13 % |

|

prepaid card customers |

345 |

379 |

-9 % |

|

customers of M2M services |

264 |

166 |

+59 % ** |

|

Fixed internet customers |

250 |

200 |

25 % |

|

TV service customers |

132 |

108 |

23 % |

|

Customers of converged services |

118 |

85 |

40 % |

Our tip

How will 5G networks affect the use of voice services?