What is the difference between centralized and decentralized crypto exchanges?

No time right now?

Crypto exchanges exist in different forms and can be roughly divided into centralized and decentralized exchanges. Decentralized exchanges are interesting because they work according to the peer-to-peer model

Contents

How does a central exchange work?

Central exchanges are trading venues where a centrally operating operator retains control of all transactions made. This assumes that you, as a participant, have great confidence in the exchange operator, after all, you have no control over the private keys for accessing your credit. If you want to carry out transactions of any kind, you have to submit a request to the exchange, and the exchange will enter the relevant data in its own database. Traditional exchanges such as the stock exchanges follow this centralized approach. This is, in a way, the model of the past.

The Binance crypto exchange is one of the most famous central trading venues. (Photo: Shutterstock)

How does a decentralized exchange (DEX) work?

In principle, all platforms for exchange transactions from peer to peer and thus between equals among each other can be decentralized exchanges (DEX). Decentralized exchanges are quite able to imitate the basic functionality of a centralized exchange with its specific advantages. This is possible because these exchanges use a blockchain for their backend. Trust in the stock exchange therefore plays a much smaller role in this approach than in the central stock exchanges.

An important differentiator to the central exchanges is that you, as the user, have the private keys to your credit. In this regard, you are no longer dependent on the operator of the exchange and retain control, for example, of your deposited coins. The decentralized exchange of digital assets is made possible by protocols such as the 0x Protocol, which runs on the Ethereum blockchain, for example.

What are the differences between the two finance concepts and what are the advantages and disadvantages?

The centralized exchanges offer a number of advantages, which essentially lie in their easy accessibility and manageability. These exchanges are easy to use and they offer various advanced trading features to make trading easier. Another advantage is that you can use your credit to pay for practically all goods and services that are available on the market. This is not always the case with the credits stored on decentralized trading venues.

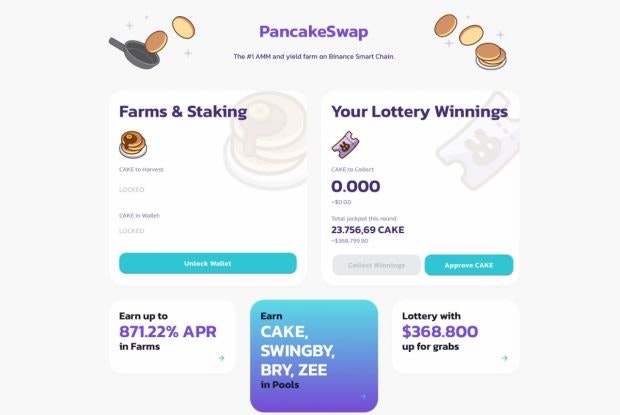

An example of Defi is the decentralized exchange Pancakeswap, which is based on the Binance chain. (Graphic: Pancakeswap)

However, the centralized approach also has significant disadvantages. The users do not receive any private credit keys and the centralized exchanges are often a popular target for hackers. The latter is now a significant security problem.

The advantage of the decentralized exchanges is that they give you back control of your money. The transactions are stored in the blockchain – in a transparent and tamper-proof way. Intermediaries are not required, the trading relationships take place peer-to-peer and thus directly between the participants of the platform. However, the storage in the blockchain is complex, the trading system does not yet achieve the speed and immediacy of the central exchanges.

An overview of important exchanges for cryptocurrencies

Here are some of the most widely used centralized and decentralized exchanges that you can use for your crypto investments:

Decentralized exchanges:

Central exchanges: