Tether and Bitfinex pay a fine of $ 18.5 million

No time right now?

The stablecoin Tether and the crypto exchange Bitfinex have to pay a fine of 18.5 million US dollars and are no longer allowed to trade in New York. A lawsuit from 2019 is thus settled.

In April 2019, the New York attorney general Letitia James filed a lawsuit against the company iFinex. iFinex operates both the Bitfinex crypto exchange and Tether Limited, publisher of the stablecoin Tether. The reason for the lawsuit was $ 850 million, which Bitfinex should have lost or embezzled. The lawsuit has now been settled against the payment of a $ 18.5 million fine.

Contents

New York Ends “Bitfinex’s Illegal Activities”

But that’s not all, as Attorney General James also banned Bitfinex and Tether from trading in New York. In a corresponding Message from the Office of the Attorney General, it is said that James is thereby ending the “illegal activities of Bitfinex”. In addition, Bitfinex and Tether will have to disclose their business activities in the future, such as payments between the two sister companies.

The lawsuit specifically concerned that Bitfinex and Tether should have tried to cover up liquidity bottlenecks through unfair measures. Tether is said to have transferred hundreds of millions of dollars to Bitfinex so that the crypto exchange could continue to guarantee payouts to customers. According to the New York Attorney General, a total of around $ 850 million “disappeared”.

Tether referred to as “stablecoin without stability”

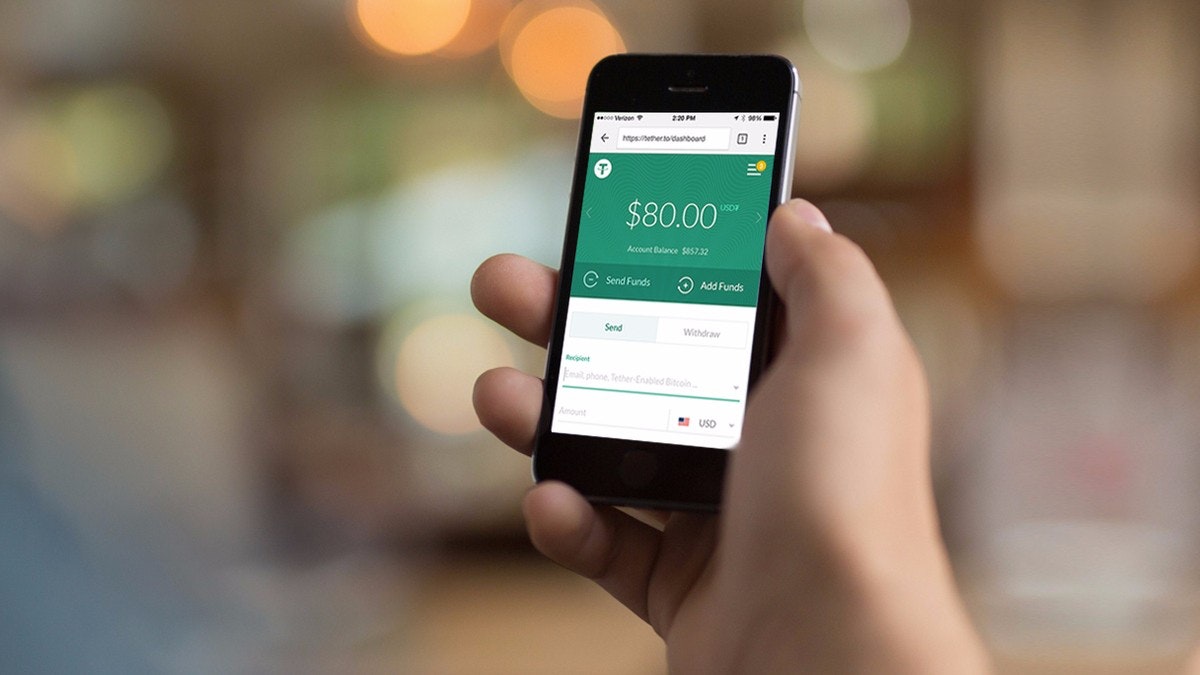

The authorities also specifically targeted the coverage of the stablecoin Tether. The company behind it claimed that each of its USDT-named coins was backed by one US dollar in a bank. Doubts about this already increased in 2017. In November 2018 at the latest, after Tether’s bank transferred the above-mentioned hundreds of millions to Bitfinex, the one-to-one coverage was no longer given, according to Attorney General James. Accordingly, James called Tether a “stablecoin without stability”.

Critics had already accused Tether and Bitfinex in 2017 of deliberately driving the Bitcoin price up. Tether, one allegation, was abused by Bitfinex as a money printing machine. Accordingly, the sister companies were also made jointly responsible for the crash that followed in early 2018. Meanwhile, Tether has become an indispensable part of the market. The coin serves as a dollar substitute when it comes to trading digital currencies. There are currently almost 35 billion USDT in circulation.