Ledger: French Tech takes Bitcoin by storm

However, this is not a newcomer since the company is already a leader in the secure holding of cryptoassets. So what will this mountain of money be used for?

If you read us, you certainly know Ledger. This French company offers USB and Bluetooth keys to encrypt access to its cryptocurrencies. The Ledger Nano S and Nano X are devices which, added to the Ledger Live software, constitute a very solid solution to protect its Bitcoins and another hundred cryptocurrencies. We had also tested the Nano S key some time ago with the boss’s savings. If he has not yet become rich, no one has stolen his nest egg. To learn more about the solutions offered by Ledger, It’s here that it happens.

Ledger always wants more

Already well established in front of companies like Trezor for example, Ledger wants more. It has indeed just raised the trifle of 380 million dollars to reach 1.5 billion valuations. Ledger therefore becomes a “unicorn”: a company that weighs more than a billion dollars. And this is not so common since there are only 15 in the French landscape.

Bernard Arnault, one of the richest men in the world, even entered the capital through one of his companies. Not bad for a start-up created in 2014, right? At the head of Ledger is Pascal Gauthier, one of the business angels at the origin of the House of Bitcoin, which later became Coinhouse. But then why such a fundraising? The answer is in 4 letters: DeFi (Decentralized Finance). “Decentralized finance” which makes it possible to lend and borrow money without going through banks.

This is a new aspect of cryptocurrency that is little known to the general public since mainstream media only scratch the surface when they tackle this subject: ” it’s rising“,” it goes down“,” it is used by criminals“,” it pollutes“,” it kills baby cats »(OK, we invented this one).

DeFi: the future of crypto

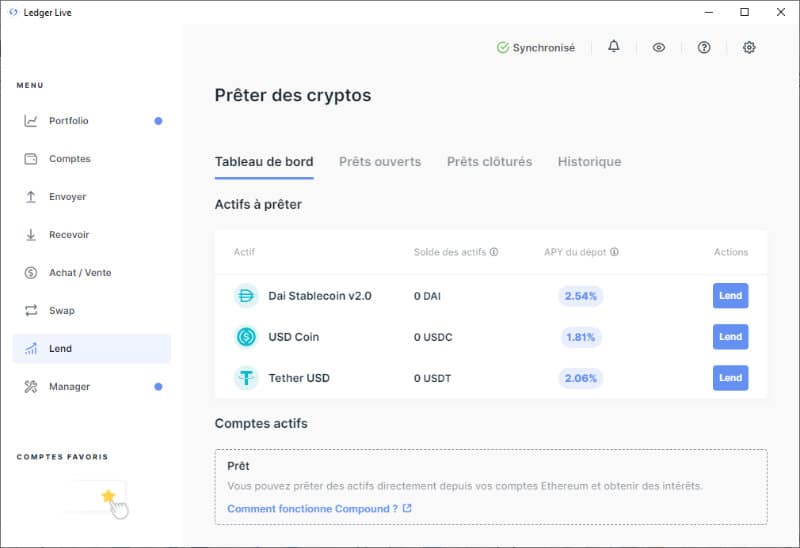

On the Ledger Live software it is already possible to deposit funds to withdraw interest in Dai Stablecoin, USD Coin and Tether USD (three currencies indexed to the dollar and which experience very little fluctuation). The interest rates vary according to supply and demand, but it is anyway much more than a Livret A with risks close to 0 since they are not sensitive to the enormous variations of the market. Bitcoins for example. The goal of this fundraising is to offer Ledger much more latitude by offering more possibilities in terms of DeFi and become a key player in the cryptocurrency market within 5 years.

French Coinhouse is also in the race

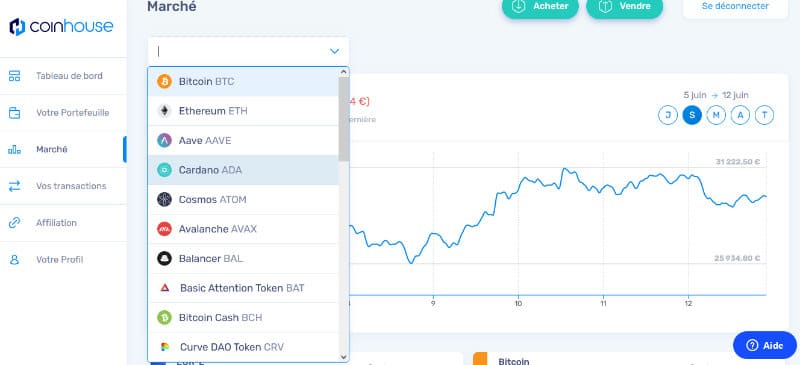

The links between Ledger and Coinhouse are quite close since Eric Larchevêque is the co-founder of both. Remember that Coinhouse is a platform that allows you to buy and sell 16 cryptocurrencies (Bitcoin, Ethereum, Ripple, Cardano, Polkadot, VeChain, Cosmos, Litecoin, Tezos, etc.) and that it is the first player market to have obtained a license from the Autorité des Marchés Financiers.

It is a company that minimizes its commissions and is even one of the first to accept the EUR-L: a stablecoin indexed to the Euro. Using this currency, the commission is only 1.49% when you shop. If you decide to take the plunge and buy cryptocurrency, it is clearly a destination of choice, because everything is explained clearly, in French with the possibility of being guided according to the risk that you are ready to accept in these investments. …