ETH holdings of the 10 richest addresses at record level

Never before have the ten largest Ethereum whales held as much ETH as they do today – this is shown by data from the crypto analysis company Santiment.

Noisy Santiment The ten richest Ethereum addresses (excluding crypto exchanges) now hold over 21.3 million ethers. The value has reached a new high for the first time since 2016. On the other hand, the top ten stock exchange addresses hold just 4.66 million ethers. That is the lowest level since 2015, according to Santiment.

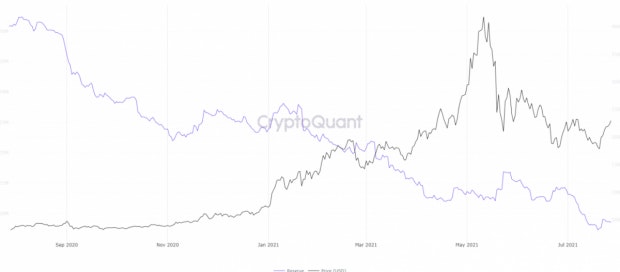

In addition, data from Cryptoquant show that this trend has been emerging for some time and that more and more investors are still withdrawing their ETH from crypto exchanges.

(Graphic: Cryptoquant)

In the past week in particular, ETH whales have massively increased their ETH holdings and more than 1.65 million ethers bought. “Ethereum whales that hold between 10,000 and 1,000,000 ETH in their respective wallets now own a total of 60.52 million coins. This is the highest amount this category has held in five weeks and represents an accumulation of 1.65 million, ”said Santiment.

In addition, the Ethereum 2.0 deposit contract also reached a new all-time high in the first week of July 2021. According to the data from Etherscan, there are now over 6.4 million ethers in the deposit contract. According to the current ETH rate, this corresponds to almost 15 billion US dollars and comprises around 5.4 percent of the total ether supply.

Contents

Is Ethereum currently more popular than Bitcoin?

If you look at the fund flows of the European crypto asset manager Coinshares, it currently looks like Ethereum is more popular than Bitcoin. A recently released report of the asset manager suggests that Ethereum investment products are currently more popular in Europe than Bitcoin investment products. In the third week of July 2021 alone, investments totaling $ 11.7 million were invested in Ethereum. In comparison, over ten million dollars flowed out of Coinshare’s Bitcoin fund over the same period. Also at Goldman Sachs Analysts highlight the growing popularity of Ethereum and believe that ETH has the potential to overtake Bitcoin in the future. Until then, however, it will be a long time. If you compare the market capitalizations of both cryptocurrencies, Bitcoin is still worth almost three times as much as ether. It is therefore unlikely that so-called flippening could occur in the near future.

author of the article is Leon Waidmann.